By Joshua Oluwafemi – Financial Consultant & Startup Strategist

🧭 Introduction

Point of Sale (POS) businesses have grown into one of the most popular micro-enterprise opportunities across Africa. With the need for quick cash withdrawals, mobile transfers, and utility payments in underserved areas, POS agents now fill a vital gap in financial inclusion.

So, how do you successfully launch and run a POS business in Africa? This guide breaks it down step by step.

💼 What Is a POS Business?

A POS (Point of Sale) business involves offering financial services such as:

- Cash withdrawals

- Deposits and fund transfers

- Airtime and data sales

- Bill payments (electricity, cable TV, water, etc.)

- BVN enrollment (in some cases)

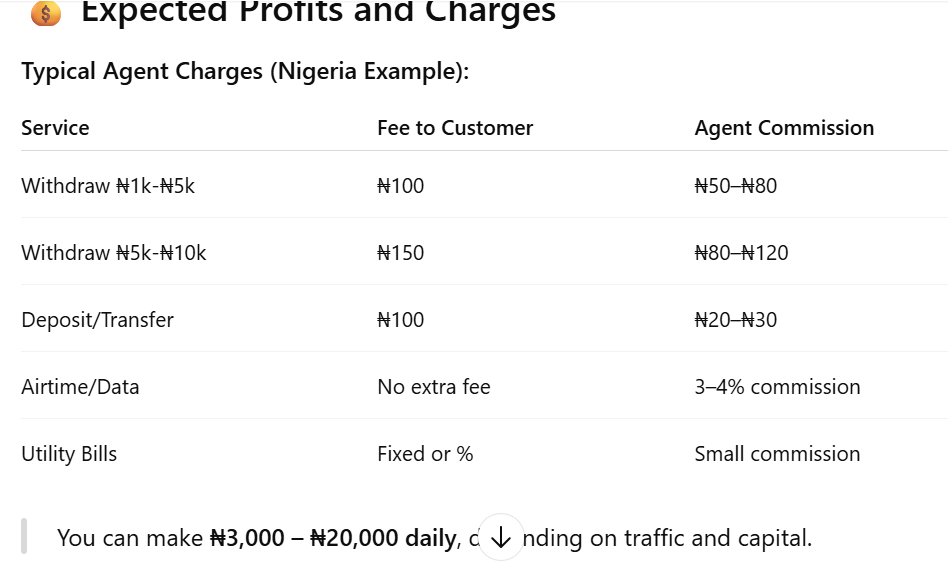

As an agent, you earn a commission for every transaction you perform. The business is low-barrier, scalable, and provides daily income—which makes it very attractive for young entrepreneurs and retirees alike.

✅ Step-by-Step Guide to Starting Your POS Business

1. 📊 Conduct Market Research

Before you invest, assess your environment:

- Is the area crowded or underserved with POS operators?

- Are there banks or ATMs nearby?

- What’s the average daily foot traffic?

- What services do people need most (e.g., withdrawals vs bill payments)?

💡 Tip: Areas with limited banking infrastructure (rural or semi-urban) are most profitable.

2. 📝 Register Your Business (Optional but Recommended)

To build trust and possibly scale:

- Register with your country’s corporate affairs body (e.g., CAC in Nigeria).

- Open a business account for settlements.

- Get a Tax Identification Number (TIN) if needed.

Helps when applying to bigger fintech companies or banks for support.

3. 🏦 Choose Your POS Service Provider

There are two main types:

A. Banks (Access Bank, First Bank, UBA, Zenith, etc.)

- Offer free terminals (in some cases)

- Lower transaction fees

- Higher documentation requirements

- Slower onboarding

B. Fintech Companies (Opay, Moniepoint, Palmpay, Kudi, Baxi, etc.)

- Fast setup

- Mobile-friendly agent apps

- More flexible pricing

- Easy to get terminals (with deposit or target-based loans)

⚖️ Compare based on: uptime, agent support, ease of use, commissions, and terminal quality.

4. 💳 Acquire a POS Terminal

You can:

- Buy a terminal (₦20,000 – ₦100,000 or equivalent)

- Lease or get it free with a deposit/target requirement

- Use Android POS (more features) or Mini POS (more portable)

Be sure to test before accepting delivery.

5. 🏪 Choose a Strategic Location

Ideal spots include:

- Market entrances

- Bus stops

- School gates

- Residential areas with poor banking access

- Busy roadside kiosks

If you don’t have a shop:

- Set up a small kiosk or umbrella stand

- Partner with an existing shop for space

6. 💸 Fund Your Agent Wallet

You need working capital of ₦50,000 – ₦500,000+ depending on:

- Expected daily cash demand

- Your agreement with the provider (some preload terminals)

- Number of services offered

💡 Start small and grow your float as demand increases.

7. 🤝 Provide Excellent Customer Service

Trust is everything.

- Dress well, be polite, be honest

- Give receipts for all transactions

- Have a signboard with your name and charges

- Offer value-added services (e.g. quick recharge, bill payment)

- Handle customer complaints quickly

8. 📈 Keep Proper Records

Track:

- Daily sales & commissions

- Cash flow (how much you withdraw and deposit)

- Terminal charges or downtime issues

- Customer complaints

Use simple tools like Excel, Google Sheets, or POS apps with dashboards.

🚫 Common Mistakes to Avoid

- Not confirming transaction success before handing out cash

- Using unreliable POS terminals

- Ignoring network or power backup (e.g. no power bank)

- Charging customers too high – they’ll run

- Operating in an already saturated area

🧠 Bonus Tips

- Run promotions (₦20 discount for frequent users)

- Partner with local shops or pharmacies

- Offer delivery cash-out (mobile withdrawal service)

- Get multiple terminals for backup

- Expand into mobile money or insurance if your provider allows

📝 Final Summary

Starting a POS business in Africa is a practical and scalable opportunity for anyone seeking a reliable daily income. With low startup costs, growing financial needs, and government support for financial inclusion, the potential is huge.

Just focus on:

- Choosing the right location and provider

- Offering honest, fast, and friendly service

- Maintaining a reliable float and network

- Scaling smartly as your customer base grows

With the right approach, you could move from a roadside kiosk to managing a POS agent network across multiple locations in 6–12 months.